Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

You have kids on the way, and this is going to become a burden on your finances you may not have fully anticipated. This is not to say that you should not have kids, but you should be aware that adding children to your financial situation will require some clever budgeting practices.

Children consume a lot and give back very little in the financial sense for the 18-years you are providing them with the totality of their room and board as well as their health care needs. The following are five tips young parents like you can take advantage of to better budget children into the family finances.

In This Post:

1. The Baby Fund

If you have a baby on the way, then you need to begin saving for this addition to your family now, not later. Setting up a baby fund in anticipation for baby-related expenses is a great way to not be overwhelmed financially when your baby arrives. Money should be set aside for a crib, diapers and even daycare costs that will be coming down the road. Even as a baby gets older, there will be school-related expenses all the way through college. These are financial considerations that all young parents must take into consideration if they want to provide their children with the best opportunities in life.

2. The Staycation

Before your baby, you may have been all excited about your annual vacation. However, since your baby came, your expenses have increased and that annual vacation trip is out of the question. However, you may get some gratification out of taking a staycation. A staycation will keep you close to home, but that does not mean you cannot splurge a little on doing something enjoyable for the family in your own area. This is both cost effective, and it can help you get the rest and relaxation you need within budget. So, start planning your staycation now, because you will be spending many vacations in your local area to ensure greater financial stability in your budget.

3. Cutting Reoccurring Costs

When going over your budget, it is important to take special notice of expenses that come up every month. Among these recurring costs, you need to ask which are necessary and which are possible to significantly cut back. With Internet streaming, for example, you can watch shows without needing a fully loaded cable package. In fact, some young parents dump cable altogether. You may even go online to search for something hovering around the cheapest car insurance available to mitigate the monthly charge on that end too. The important thing is to be honest with your needs, and allow this to influence your budgeting practices. This makes it easier for you to live within your means.

4. Plan Meals Around Sales

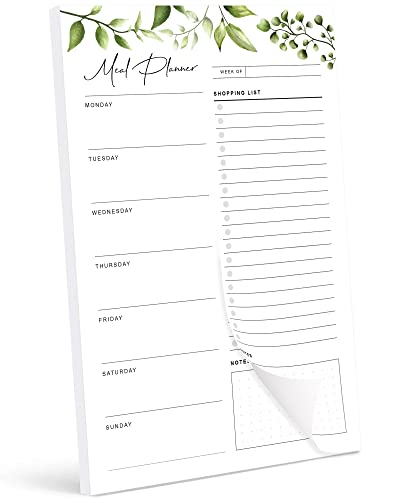

For families like yours, food costs are one of the most expensive parts of their budget. Adding another kid or two to this equation simply means more mouths to feed at a higher cost. This is why it is recommended by some to plan meals around the sales offered at your local grocery stores.

5. Walk Do Not Drive

If you live relatively close to where you work or stores you shop at, you may want to take up the habit of walking to these places, rather than driving. Walking to save on gas will not only keep fuel costs low, but it will also help to keep you fit and trim. So, you can use this exercise outlet as an excuse to drop that expensive gym membership and save even more money.

Conclusion

Young parents in your situation have a lot of decisions to make when formulating a workable budget. In many cases, this is where you will be forced to learn that financial sacrifices must be made to ensure your family has the things it needs to get by from month to month. Anywhere you can cut costs and transfer those cuts to savings is going to be helpful as you are confronted with future financial demands you did not even know were coming your way. It is the expenses you did not see coming that will test the financial fiber of your budgetary attempts. Yet, you can be sure these unforeseen costs will come at the most inopportune times. So, it is best to be on top of your budget to make sure you can weather the coming financial storms that every family with children on the way faces.