Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Being a single parent means you have to depend on just one salary to support not only yourself but also your highly dependent little one. According to CostFreak’s average expense in raising a child, parents will need around $233,000 to provide for a single child, starting from birth until he/she reaches 17 years old.

While a couple can share this financial responsibility, a single parent will have to shoulder all of the expenses on his or her own. From my experience, I can say it is indeed a daunting task, but it is possible to handle the budgeting. As such, here are 10 practices that can help single parents save for their kids future.

In This Post:

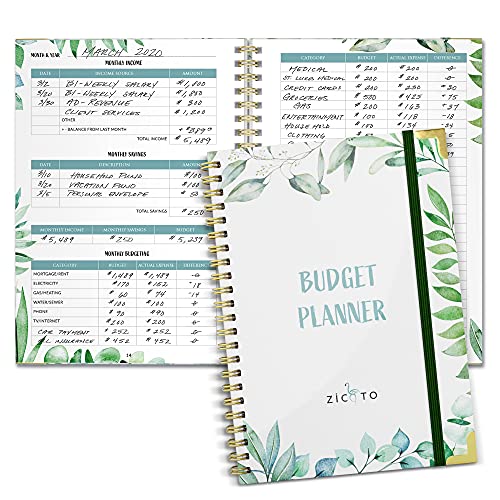

1. Create a Budget

A budget is something that everyone needs to have, whether you are a single parent or not. It is important to know how much you have, and then decide how much you will need to spend and how much you should save for important things like your child’s education.

I work from home and earn around $1000 every month. From my monthly income, I always make sure to set aside $200 for my savings. The rest of my money will be budgeted on everyday necessities like food and house bills. Although it really depends on how much you earn every month, the tip is to follow a strict budget plan.

2. Sacrifice Luxury

Simply put luxuries as your wants or things that you really don’t need. Since you’re raising a child on your own, it will be helpful to make a few sacrifices so that you can save for your kid’s future. However, this does not mean you should live a difficult life. Of course, you can still buy the things you like, but make sure you have already taken care of the more important items. It may not be easy at first, but eventually, you’ll learn to get used to it.

3. Save Change

Did that make you a bit confused? Change here means the amount you get after paying in excess. Many people may look at coins as useless and may be quick to give them out to a homeless guy on the street. Now, it is not bad to help people in need, but that change after paying the bill at the grocery store can contribute a lot to your child’s future. Their value may not be that big, but with a piggy bank, you can save those coins and a bigger amount of money over time; “one by one makes a bundle”.

4. Avoid Going Into Debt

It may seem obvious, but many people still end up in debt. One of the biggest culprits to landing you into debt is postponing your bill payments. Always ensure to pay your bills on time. If possible, have an automatic arrangement with the bank so that monthly bills are deducted and paid on time. If you have a credit card, then use it responsibly. Don’t just buy lavish things and end up not paying any of them; that wouldn’t be good for your family.

5. Get Medical Insurance

It is next to impossible to raise a kid and never have to make a trip to the doctor. These visits to the doctor can be really expensive so plan ahead before your child gets sick. It is usually cheaper to make regular premium payments than paying an entire medical bill on your own.

6. Never Spoil Your Kids

As a single parent, I try to provide the best things for my daughter. But there are times when she asks for things she wants, especially toys. If I do have the money, I usually settle for something similar yet at a lesser price. When I don’t have enough left, I always tell her my reasons why I can’t buy what she likes. Because the moment I give into her, it would mean struggling days until my next paycheck comes, or my savings would trim down a bit.

7. Open a Savings Account

You may have a separate savings account where you can keep a portion of your income for your little one. I actually do this, and it has really helped me raise my kid. I get my monthly paycheck and deposit some of it in my savings account. By doing this, you won’t be tempted to splurge all of your income at once.

8. Be Healthy

When you’re healthy, you’re able to work effectively. But if your body is not always conditioned properly, then chances are: you’ll skip work, and it will result in deductions from your salary. Apart from that, you need to spend on medications, and sometimes, hospital visits, which can cost you a lot.

Remember, you are the sole provider of your child. It’s not ideal to get sick. To make sure that you and your child stay fit, eat healthily. By eating healthy, you prevent yourself from going to the doctor.

9. Buy at Discount Stores

There’s nothing wrong with being frugal. I choose to buy affordable clothes at discount stores, but I pick those with good quality. I delve away from spending on branded items because they’re too expensive, and I know I can buy more necessities for my kid with the money supposedly used for costly purchases.

10. Secure a Life Insurance

Life insurance ensures that you have left something for your child’s future if you are no longer there with him/her. If you do not have a lot to leave behind for your child, a life insurance policy can ensure that there is something substantial for your child when you are gone.